The bond market is a platform where entities like governments and corporations raise funds by issuing debt securities, known as bonds. Investors lend money to these issuers in exchange for periodic interest payments and the return of the principal amount upon maturity. In India, the bond market is bifurcated into:

- Government Securities (G-Secs): Issued by the central and state governments, these are considered low-risk.

- Corporate Bonds: Issued by companies to finance operations, offering higher yields but with increased risk.

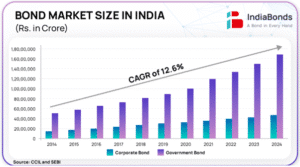

As of 2025, India’s bond market stands at approximately US$2.69 trillion, with government securities accounting for about US$1.24 trillion and corporate bonds around US$598.2 billion.

📈 Trends in the Indian Bond Market (2025)

The Indian bond market in 2025 is witnessing significant developments:

- Domestic Borrowing Surge: Indian firms raised a record ₹987 billion through local bond sales in April 2025, driven by falling local yields and ample liquidity.

- Regulatory Reforms: SEBI reduced the minimum investment size for corporate bonds from ₹1 lakh to ₹10,000, enhancing retail participation.

- Global Recognition: India’s inclusion in the JPMorgan Global Bond Index in 2024 and the upcoming FTSE Russell index inclusion in September 2025 have bolstered foreign investor confidence.

⚠️ Risks in the Bond Market

Investing in bonds carries certain risks:

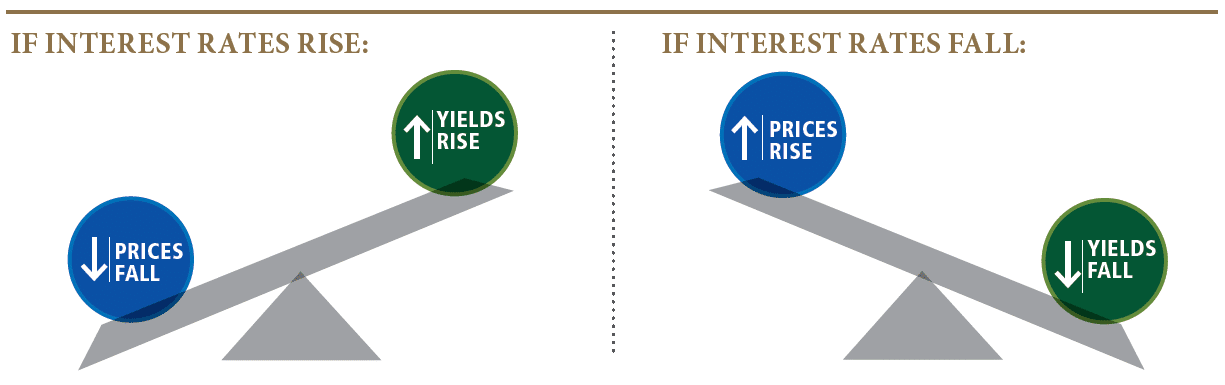

- Interest Rate Risk: Bond prices inversely relate to interest rate movements; rising rates can erode bond values.

- Credit Risk: Corporate bonds, especially lower-rated ones, carry the risk of issuer default.

- Liquidity Risk: The secondary market for corporate bonds in India remains underdeveloped, potentially making it challenging to sell bonds before maturity.

Note – “The essence of investment management is the management of risks, not the management of returns.”

— Benjamin Graham

Credit Rating in Bond Market

Credit ratings are evaluations of a borrower’s creditworthiness, particularly their ability to repay debt on time. In the bond market, ratings are assigned by credit rating agencies like CRISIL, ICRA, CARE Ratings, India Ratings, and global firms like S&P, Moody’s, and Fitch.

📋 Credit Rating Scale for Debt Instruments in India

Here’s a standard credit rating table used by Indian rating agencies for long-term and short-term debt instruments:

|

| Rating | Meaning | Risk Level |

| A1+ | Very strong capacity to meet obligations | Lowest risk |

| A1 | Strong capacity | Very low risk |

| A2+ / A2 | Moderate capacity | Moderate risk |

| A3 | Weak capacity | Elevated risk |

| A4 | High risk of default | High risk |

| D | In default | In default |

Note: Different agencies may use slightly different notations (like adding “ICRA” or “CRISIL” as prefixes), but the rating logic remains the same.

💼 How to Invest in the Indian Bond Market

Investors can access the bond market through:

- Direct Investment: Purchasing bonds via brokerage firms or platforms like Vested, requiring a Demat account.

- Bond Mutual Funds and ETFs: Investing in funds that hold diversified bond portfolios, offering professional management and liquidity.

- RBI Retail Direct: A platform allowing retail investors to buy government securities directly from the RBI.

📊 Yield Curve and Bond Price Relationship

The yield curve illustrates the relationship between bond yields and their maturities. Typically, longer maturities offer higher yields, resulting in an upward-sloping curve. However, economic factors can cause inversions.

Note: Bond prices move inversely to yields. When interest rates rise, existing bond prices fall, and vice versa.

💰 Taxation on Bond Investments

Tax implications for bond investors in India include:

- Interest Income: Taxed as per the investor’s income tax slab.

- Capital Gains:

- Short-Term (held ≤12 months): Taxed at the individual’s income tax rate.

- Long-Term (held >12 months): Taxed at 10% without indexation benefits.

📝 Conclusion

The Indian bond market in 2025 presents a compelling opportunity for investors seeking stable returns amidst global uncertainties. Regulatory reforms, technological advancements, and increased accessibility have made bond investing more attractive than ever. However, it’s crucial to assess risks and align investments with individual financial goals.