Chemical sector – Solving “CHEMICAL LOCHA”

Indian Chemical Sector Report in 2025, your ultimate guide to understanding

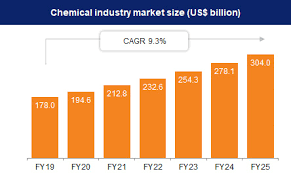

the Chemical Industry in India. As the 6th largest producer of chemicals

globally and the 3rd in Asia, India's chemical sector is a pivotal contributor to the national economy.

The sector is expected to grow at a CAGR of 11–12%, reaching $290-310 billion by 2027, fueled by rising demands in specialty chemicals and petrochemicals.

Export share is roughly 12-13% of the industry size, but has strong potential to

grow in future.

World chemical industry bifurcation

World chemical industry – india is 3%, china 40%, Europe – 20%, America – 16%

and others, this is despite growing capacity 4 time in the past from a decade.

Segments of Business

1. Bulk Chemicals

Commoditygrade products (e.g. caustic soda, phenol, chloralkali) produced in high volume; margins fluctuate with global cycles.

2. Specialty Chemicals

Niche performance chemicals for B2B applications—cosmetics, adhesives,

electronics—delivered in low volume but higher margin, with strong global demand amid China+1 supply shifts

3. CDMO – Limited players especially in export business in India – PI IND and laurus lab making and impact through customer retention, innovation and.R&D

4. Agrochemicals

Includes active ingredients and crop protection formulations. Projected 7–9% growth in FY26; margins expected to recover to ~12–13%

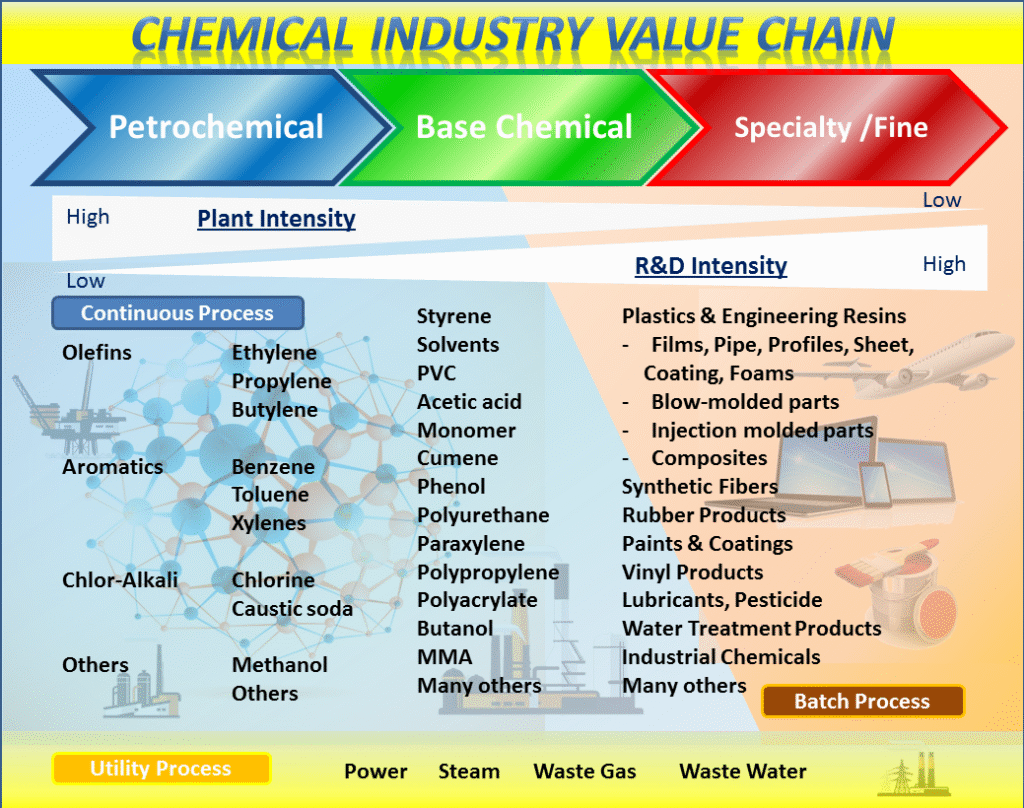

Value Chain of the Chemical Industry

The value chain ranges from raw materials (petrochemicals, minerals) → bulk/basic chemicals (e.g., caustic soda, phenol, alkylamines) → intermediates/fine chemicals (e.g., βlactams, agrochemical intermediates) → specialty chemicals (e.g., performance additives, pigments, solvents) → formulations/end-products (e.g., agrochemicals, adhesives, personal care)

Financials & Emerging Trends

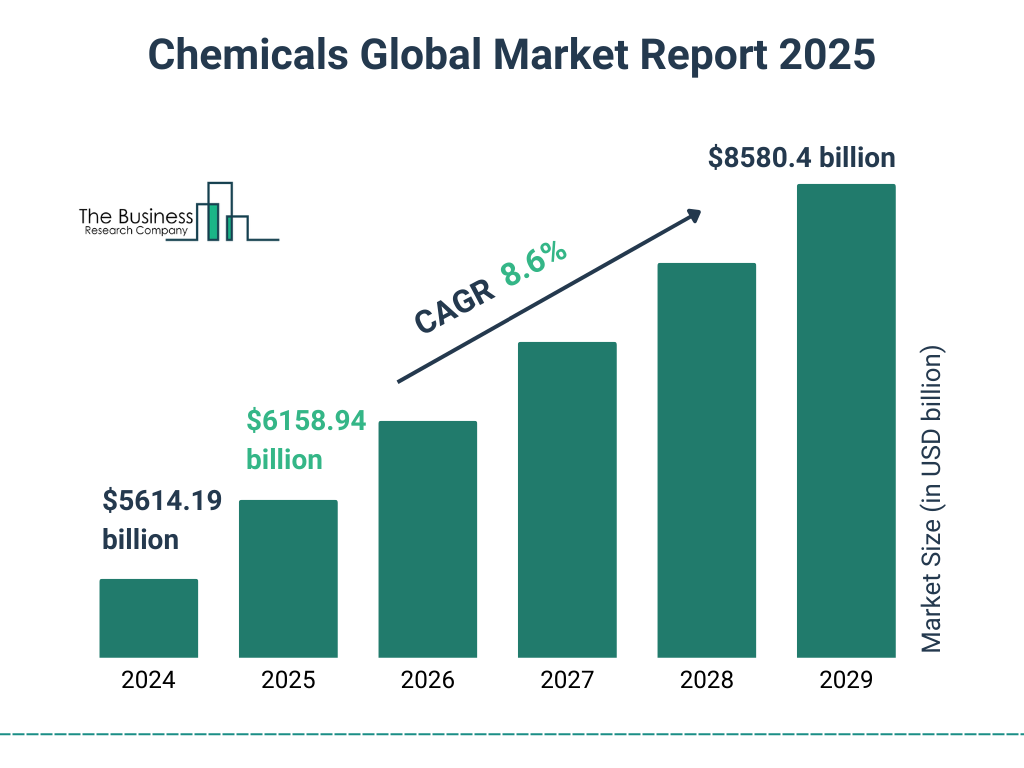

Industry Growth – India’s chemical market was around $220 billion in 2023, projected to reach $383 billion by 2030—a CAGR of ~8%

Specialty Segment – Grown at ~9–12% CAGR, expected to hit $300 billion by 2026.

Financials – Bulk margins hover at 10–20% while specialty margins reach 20–35% onaverage.

Trends – Sustainability, ESG focus, digitalization (Industry 4.0), derisking from China, and increased R&D (spending up 7–8% CAGR on R&D over past decade)

Valuation Outlook FY26–FY27

Sector Valuation – Market cap/share prices reflect strong growth expectations. Specialty chemical stocks often trade at 15–20× FY26 EPS; agrochemical and bulk are 12–15×.

Earnings Growth – Firms such as SRF, Vinati Organics, PI Industries are expected to deliver 10–15% revenue growth and margin expansion from H2 FY26 onward.

Stock Performance – Equity analysts rate key stocks (Aarti, SRF, Rossari) as “Buy”,

citing structural shifts in global supply chains and PLI support.

CAPEX & Big Investment Opportunities

Capex Drive – Listed chemical/agro firms (11+ excluding UPL) invested ~₹4,100 Cr

(FY17–21), with FY26 capex guidance ranging from ₹200 Cr (small firms) to ₹2,300 Cr (e.g., SRF).

Mega Projects – Haldia Petrochem’s $10 billion oiltochemicals project (3.5 Mtpa

cracker) will deepen southern capacity by 2029

Supplychain Resilience – Excel Industries and others are pushing localisation ofintermediates (e.g., chlorine, isobutyl benzene), collaborating with global MNCs to reduce reliance on China.

✅ Summary Highlights

Value Chain: From commodities to high-margin specialities and end-use formulations

Segments: Bulk (volumes), Specialty (performance), Agro (growth)

Financials: Growing steadily (~8–12% CAGR), with higher margin profile for speciality and agro

Valuation: Premium multiples for specialty and agro; strong growth outlook into FY27

Capex & Investment: ₹200 Cr–₹2,300 Cr planned, with several mega-integrated projects underway